Avoiding probate is often a goal of many estate planning clients. Clients might have had a bad experience with a previous probate administration. As a result, those clients may want to avoid probate if at all possible. Avoiding probate is possible and here are some ways to do so:

A trust: A trust is an agreement between the grantor (the client) and the trustee. The trustee agrees to hold property for the benefit of somebody. That “somebody” can be the grantor or a third party. Any property contained within the trust is considered non-probate property. Non-probate property does not go through a probate administration. In the case of property in a trust, at death, the property will be transferred outside of a probate administration to beneficiaries in accordance with the terms of the trust.

Paid on Death Account: The law in Indiana allows for financial institutions to set up paid on death accounts. This type of account allows account owners to designate who will receive the funds directly upon the death of the account owner. The law treats these accounts as non-probate property. Therefore, any property contained within a paid on death account will not subject a client to a probate administration.

Transfer on Death Deed: A transfer on death deed operates in the same manner as a paid on death account except that the transfer on death deed deals with real property instead of financial accounts. When a transfer on death deed is signed and recorded with the county recorder, it allows the real property, such as a house or a farm, to be transferred directly to beneficiaries designated within the transfer on death deed.

The law allows for other mechanisms to avoid probate, e.g. joint ownership, but the result is not always optimal. For instance, if a house is held jointly by a husband and wife, the house will not go through probate when the first spouse passes away. However, when the surviving spouse dies, then the house may become a probate asset. These three mechanisms are preferable mechanisms to avoid probate.

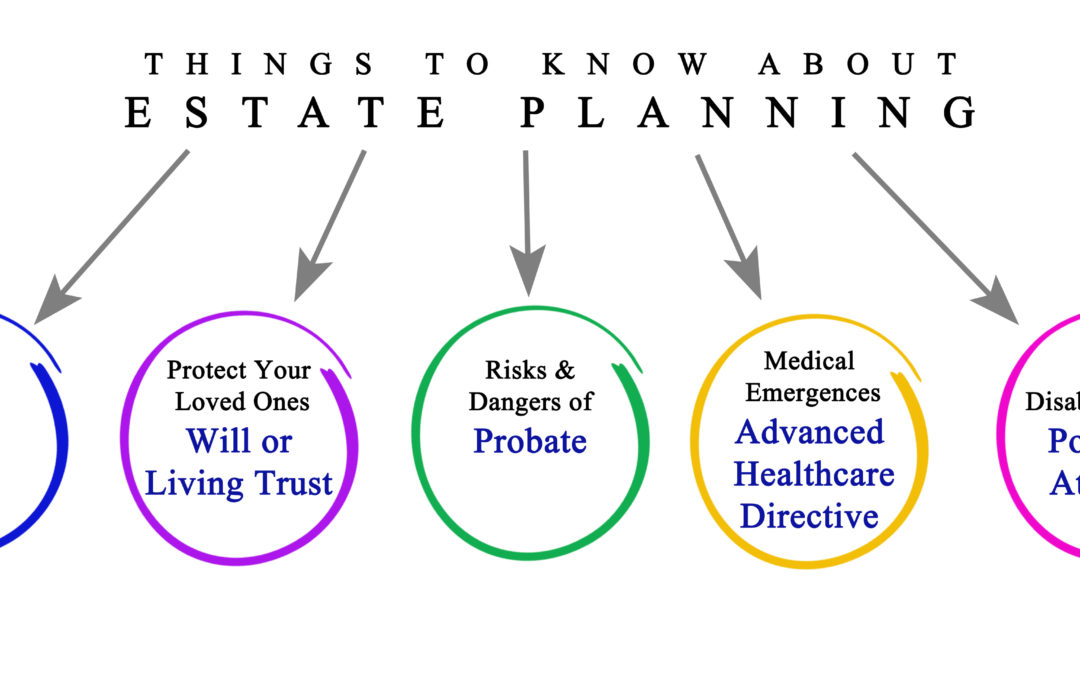

Have you heard horror stories about a probate administration gone wrong? Or have you only heard rumors that you should try to avoid probate? The truth is that many probate administrations are not a big deal. But there are some detractions to going through a probate administration. Here are a few:

PUBLIC: A probate administration is a public court case. This means that the public at large will have access to many if not all of the court’s records for the estate. In particular, the public nature in the estate administration requires that the Last Will and Testament of the decedent be made public. For those individuals who are very private in their dealings with others, it is an unwelcome prospect that their entire estate might be made known to all who inquire.

CREDITORS: An individual’s creditors have a right to be notified regarding the opening of an individual’s probate estate. From the time that the creditors are put on notice of the opening of the estate administration, the creditors have three (3) months within which to file a claim against the estate. Once a creditor files a claim against the estate and that claim is valid, then the creditor will be paid by the estate prior to final distribution to beneficiaries.

WILL CONTESTS: Of course, it’s always possible that family members and any other beneficiaries will challenge the validity of the individual’s Last Will and Testament. When this occurs, the attorney fees increase and each beneficiary’s share decreases. Ultimately, the beneficiaries lose out. Because the will contest is in the public forum, anybody can come and contest the will. If this is a concern for a client, it might be advisable to set up a trust so nobody has a chance to contest the will.

ATTORNEY FEES: Related to point #3 is the expense of attorney fees. A simple estate administration will cost some money. But if there are any complexities to the estate administration, then the cost can rise fairly dramatically, especially if there are beneficiaries who are fighting each other within the estate administration.

These are a few reasons why probate has a bad reputation. Certainly, an estate administration in some instances is unavoidable if the proper estate planning hasn’t been put into place. However, when an individual desires to avoid probate, it is possible so long as he/she does the estate planning in advance.